By Rona Gindin

Chinese tourists have become an all-important leisure market. More than 154 million Mainland Chinese residents traveled abroad last year, and that number surges higher every year. This exclusive story for InPark explores this vital new consumer pool: who they are, what they want to experience, and how they use technology and social media to find and share information and make transactions when they visit theme parks, water parks, museums and visitor attractions in Asia, the U.S. and Europe.

ABOVE PHOTO: Chimelong Safari Park. Courtesy Chimelong Group

Introducing the Mainland Chinese traveler

From millennials through young seniors, residents of Mainland China have more disposable income than ever before, and they’re using some of it to explore their country and the world. “Fundamentally, you’ve got 1.3 billion Chinese, and about 300 million more are middle class than 10 years ago,” said Chris Yoshii, vice president and global director of leisure and cultural services for AECOM. (AECOM partners with the Themed Entertainment Association to produce the annual TEA/AECOM Theme Index, a global attraction attendance report.) “They’re very eager to go out into the world and see different places, especially famous ones. The numbers will continue to grow at double-digit rates throughout the next decade. We’re just seeing the tip of the iceberg,” he predicted.

These active travelers like to do and see new things at a steady pace. Beyond that, they’re diversified. “There is no typical Chinese traveler,” explained Christopher Ledsham, chief communications officer of the China Outbound Tourism Research Institute, or COTRI. Wealthy residents from first-tier cities have developed a taste for adventure in locales exotic to them, he elaborated, while travel newbies from smaller markets want to stay closer to home – first exploring other Chinese cities, then nearby countries such as Thailand or Vietnam for their first out-of-country experience. Once they get started traveling abroad, though, Chinese tourists keep moving. Those venturing beyond the mainland visit 2.1 countries or regions a year, reported “Outbound Chinese Tourism and Consumption Trends: 2017 Survey,” a report by Nielsen and Alipay, which predicts the figure will rise to 2.7 in 2018.

The COTRI China Outbound Tourism Research Institute profiles various niche markets in a series of short info-packed videos called China Outbound Travel Pulse on a dedicated YouTube channel. “Every niche has millions and millions of people in it, so each segment is infinite,” said Ledsham.

International growth potential

As big as this market is, it continues to increase tremendously every year, with a huge pool yet remaining. Only eight percent of Chinese residents have passports, according to “Thailand Loves Its Chinese Visitors, up to a Point,” a February 2018 article in the Wall Street Journal, and the percentage rises regularly.

So vibrant is this market that the number vacationing out-of-country grew by double digits annually from 2002 to 2013, according to the United Nations World Tourism Organization (UNWTO), and by 2012 the Chinese secured their place as the No. 1 spenders in international tourism; that hasn’t changed since. The $261 billion they spent in 2016 was 21 percent of the world’s total, UNWTO reported.

Despite this growth, Chinese citizens still face some practical hurdles in visiting numerous global destinations, with the country’s passport ranked only 67th in the Global Passport Index; 129 states worldwide still require Chinese travelers to obtain a tourist visa before visiting. But some countries have taken steps to simplify access and are rewarded with healthy, growing numbers of Chinese tourists, including the United States, Morocco, Tunisia, Japan and Indonesia.

Political issues can drive trends

By contrast, the Maldives, South Korea and Thailand all saw drops due to inter-governmental tensions, according to the Wall Street Journal story. For example, half as many Mainland Chinese visited South Korea in 2017 than a year earlier, the article reported, saying that China “blocked tour groups” because the two countries were “locked in a political row.”

That didn’t end relations, and South Korea is ranked the third most popular destination for Mainland Chinese tourists, with 27 percent of surveyed respondents having visited the country “in the 12-month period we studied,” noted Deborah Weinswig, CEO and founder of Coresight Research.

Politics and the economy are always factors. Weinswig observed that “the top two concerns for continued strength in Chinese tourism to the U.S. is the impact on the value of the yuan-U.S. dollar exchange rate, and if the political climate were to have any impact on security concerns in the U.S.”

And it is all about safety. “Safety is always the number one concern of Chinese tourists,” she said. “Any perceived instability would have a negative impact on growth.” This does not include [Great Britain’s] Brexit decision, however: “the UK has experienced a recent increase in Chinese tourism since the decision, as Chinese tourists look to take advantage of the weaker pound,” Weinswig said.

Understanding the travel patterns

As mentioned above, tourists from Mainland China tend to begin by exploring within their own country first – a trend that is growing with the nation’s rail expansion (see sidebar) – then proceed to other Asian countries, then venture farther as they gain confidence. In 2017, according to UNWTO, Chinese tourists went to Thailand in the greatest numbers, followed by Japan, Singapore, Korea, Malaysia, the United States, Indonesia, Vietnam, the Philippines and then Australia.

Nielsen reported that 38 percent have seen Europe (mainly France, the United Kingdom and Germany), 25 percent North America, and 20 percent Australia and New Zealand.

Once they’ve had their time in other Asian countries, Europe and the U.S., it’s all about adventure, and Mainland Chinese tourists will then put Egypt and Africa at the top of their lists, said the Fung/Coresight report. African safaris, South African glamping experiences, Antarctica forays, plus bungee jumping and sky diving in places like New Zealand are also on their itineraries, COTRI said.

Younger, more independent travelers have tighter budgets, but they are the fastest growing segment. They’re headed to Canada, Australia, the United Arab Emirates, Malaysia, Czech Republic and Spain, said the COTRI and Dragon Trail China Outbound Travel Pulse videos. They seek out local experiences and cultural immersion, and they use apps to book homestays.

$206 per day

Older Mainland Chinese travelers tend to prefer travel with traditional tour groups, while seasoned mature Mainland Chinese are willing to put their budgets toward custom tours or traveling solo, Nielsen reported. To this day, 34 percent of Chinese take an old-fashioned package tour, while others opt for independent travel (49 percent), semi-independent (42 percent), and customized travel (25 percent).

Shopping has traditionally been a huge part of the experience, spending freely on luxury items. On average, each Chinese tourist spends $672 shopping during an overseas trip, according to the 2017 Nielsen report. That’s decreasing somewhat, said COTRI, which found that in 2017 Chinese international travelers spent 37 percent less on shopping while abroad and 14 percent more on dining. This is for a variety of reasons having to do with regulations, taxes and e-commerce.

Since they’re shopping less, that leaves money for attractions and theme parks, among other activities. According to Nielsen, in 2017 outbound Chinese tourists averaged $5,565 per person per trip, $3,064 of that on location (not including airfare and group tour costs), with a 3 percent rise to $5,715 expected for 2018. The farther Chinese tourists go from home, the bigger their expenditures, Nielsen added. On average, they spent $3,451 in Australia and $3,064 in the United States, less in Asian countries.

Chinese tourists are starting to stay in one place longer. That leaves time for local museums and other cultural venues. Still, according to “China 2016 L.A. Visitor Profile” shared by Discover Los Angeles, in 2016, 90 percent of visitors from China did indeed shop, while 62 percent dined in high-end restaurants and 58 percent visited amusement or theme parks. These visitors – whose numbers skyrocketed from 273,000 in 2010 to 1.3 million in 2018 (the last two years are estimated), spent $206 a day.

Theme parks remain popular

Mainland Chinese tourists don’t go abroad only to try out theme parks, but a big chunk – 41 percent – still make time for such attractions, Nielsen reported. Most are married couples in their 30s traveling with children, and groups of young adults in their 20s. (By contrast, non-Chinese tourists prefer natural attractions and museums.) Once they’re on the property, they buy things. Sixty-six percent spend more money inside the attraction than on admission, Nielsen said, including food (75 percent) and shopping (68 percent).

While they’re in theme parks, these tourists enjoy mild rides and shows, but not thrill rides, noted AECOM’s Yoshii. “Mainland Chinese typically like colorful family rides and even the kiddie rides, including family coasters, and flat, round and dark rides,” he observed. “They also really like performance, stunt, fireworks and song-and-dance shows, including spectaculars.”

Welcome!

Experts recommend that theme parks and other attractions adjust service styles and technology to accommodate Mainland Chinese tourists.

As for hospitality, 10 years ago, Ledsham said, the basics were WiFi, TV stations in Chinese (which aren’t as important now that smartphones and WiFi are ubiquitous), and hot water dispensers, since Chinese tourists like to have that available for drinking.

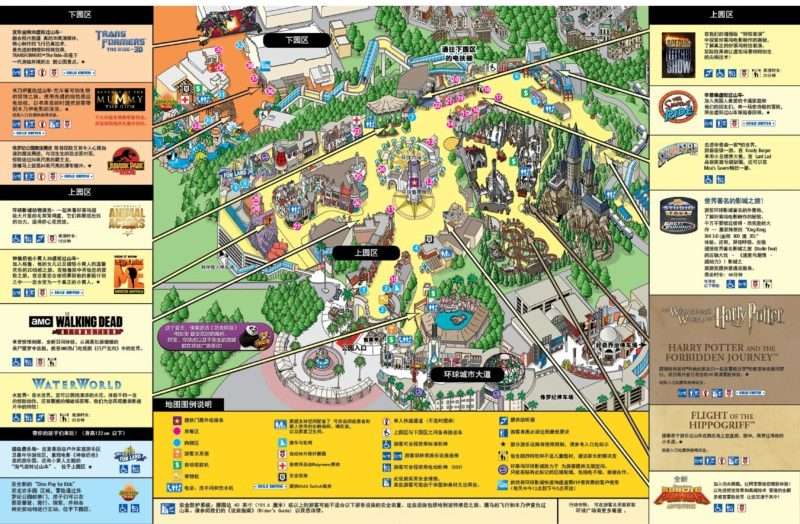

Today, operators would be wise to add Chinese-speaking staff, a Chinese-language map of the attraction and a Chinese-language overlay of the app to enhance the guest experience, advises Yoshii. “If you don’t want to develop a sophisticated app, create a download with maps and descriptions in Chinese of attractions and restaurants within your theme park that will interest Chinese visitors,” he said.

Shopping choices can be overwhelming, so attractions should simplify retail displays, Ledsham noted. “Have signage that points out your best seller, your special of the month and your premium product.”

These visitors may be open to trying an attraction’s signature foods, but they’ll also want foods they know from home, Yoshii noted. “Make sure the outlet that sells it is marked boldly on a Chinese-language map, and provide a Chinese-language menu.”

Many efforts can be taken in conjunction with other attractions and lodging facilities. Las Vegas providers joined forces after seeing the number of Chinese tourists to Las Vegas jump 13 percent in 2016, reported Kala Peterson, communications manager, Las Vegas Convention and Visitors Authority. Through a program called “China We Welcome You,” the Authority taught resorts and other tourism partners basics regarding behavior, payment methods and effective welcoming techniques.

Accommodate the apps

Arguably the most important thing attractions can offer is the ability to let their Chinese tourists pay with the apps they use at home. While only 11 percent of most international travelers pay with such apps, said Nielsen, 65 percent of Mainland Chinese tourists do. For tourist attractions, that number is 58 percent. They do use bank cards and cash, Nielson noted, but mobile apps are more important to them than to other travelers. The reasons: convenience, speed and familiarity; pride of seeing Chinese brands; no need to deal with currency exchange discounts; and relevant marketing promotions.

Marketing

Marketing to this customer community involves understanding their unique habits and mindsets.

Online actions tend to be effective. Travel agents are fading out, as is print media. It’s important to have a Chinese-language version of your website, yet the most effective marketing will involve smartphones and social media.

“The Chinese skipped the desktop Internet era,” Ledsham reported. “Mobile is absolutely the way forward.” Specifically, he advised creating a relationship with the Chinese online travel agency Ctrip, which acquired [the European travel fare aggregator] Skyscanner in 2016. “Those apps reach Chinese tourists where they are at the moment, allowing them to change their plans such as to see a dolphin show on a whim. Plus, they do so in the Chinese language, allowing payment in Chinese currency.”

Using this media, create meaningful messages, added Ledsham. “The Chinese can ride roller coasters in Singapore without flying all the way to California. They can see alligators by the Yangtse River, which is closer than Florida. To reach this consumer, tell a story so you stand out.

Operators should set up great photo ops that travelers will share on social media. “The Chinese really believe in world of mouth, from both peers and famous influencers,” said Ledsham.

Keeping up with trends – as they change at lightning speed – will be worth it to attraction operators, as Chinese continue to acquire passports and head for the road, the train or the skies.

How the Mainland Chinese tourist chooses where to go

In addition to preferring natural scenic sites and theme parks, this group cares about experience more than price, Nielsen reported.

Their top five priorities are beauty or uniqueness of tourist attractions (56 percent), safety (47 percent), ease of visa procedures (45 percent), friendliness of locals to tourists (35 percent) and affordability (34 percent). All others, collectively, followed beauty and uniqueness with affordability, safety, vacation time constraints and alignment with their schedules.

Once the decision is made, Mainland Chinese tourists visit an eclectic group of sites, although theme parks have a strong showing. Here are some top choices according to Nielsen:

Hong Kong: Hong Kong Disneyland

South Korea: Chejudo (Jeju Island)

Taiwan: Riyuetan Pool

Japan: Tokyo Disneyland

United States: Disneyland

Australia: Sydney Opera House

Thailand: Phuket Island

France: Louvre Museum

In-country rail travel expands

Mainland Chinese tourists aren’t going straight from the local theme park to a country half a globe away. They start by traveling within China, and more each year are doing that thanks to regular and high-speed train lines that were recently built connecting cities of all sizes around the country – a big change from the busses that have long served this purpose.

“The high-speed rail system growth is phenomenal and all mid-size cities in China will be linked,” said Chris Yoshii of AECOM. “In addition, intercity and metro line systems are being built in and between major cities, and inner-city transit systems link in, forming a comprehensive network.”

These systems are being extended close to theme parks’ front gates. “The impact is a greater proportion of theme park attendance by domestic tourists,” he added.

The last of a “4+4” system linking countries north to south, and east and west, will be completed this year, according to “China’s High-Speed Trains Are Taking on More Passengers in Chinese New Year Massive Migration,” a February 2018 Forbes article. Another 24,000 miles will likely be added by 2025. In fact, existing and new rail is expected to host 3.25 billion passenger trips this year, nearly 7 percent more than a year earlier, according to China Daily in “Rail System to Grow by 4,000 km in 2018,” a January 2018 story.

Once they get used to leaving home, though, those with means quickly grow ready to leave the country for vacation. “Domestic travel is growing, and as people become more comfortable with travel they will then go to nearby countries first,” Yoshii said. “Then they are global travelers. But it happens very fast with a large number that are really free independent travelers looking for very unique places and experiences.”

Journalist Rona Gindin (www.ronagindin.com) has been covering travel from various business and consumer angles for three decades, and today follows the attractions and travel industries from an Orlando, Florida base.

Journalist Rona Gindin (www.ronagindin.com) has been covering travel from various business and consumer angles for three decades, and today follows the attractions and travel industries from an Orlando, Florida base.