by Edmond Chih, Director, and Edward Shaw, Principal, of Entertainment + Culture Advisors (ECA)

The attraction industry is rapidly evolving and moving beyond COVID-19. New developments and operational approaches in Europe, the Middle East, and Africa (EMEA) provide a case study of the industry’s evolution. Having worked extensively throughout the region over the past decade, Entertainment + Culture Advisors (ECA) has outlined the changes occurring in the regional industry and the path ahead, as highlighted by major attraction trends and new projects.

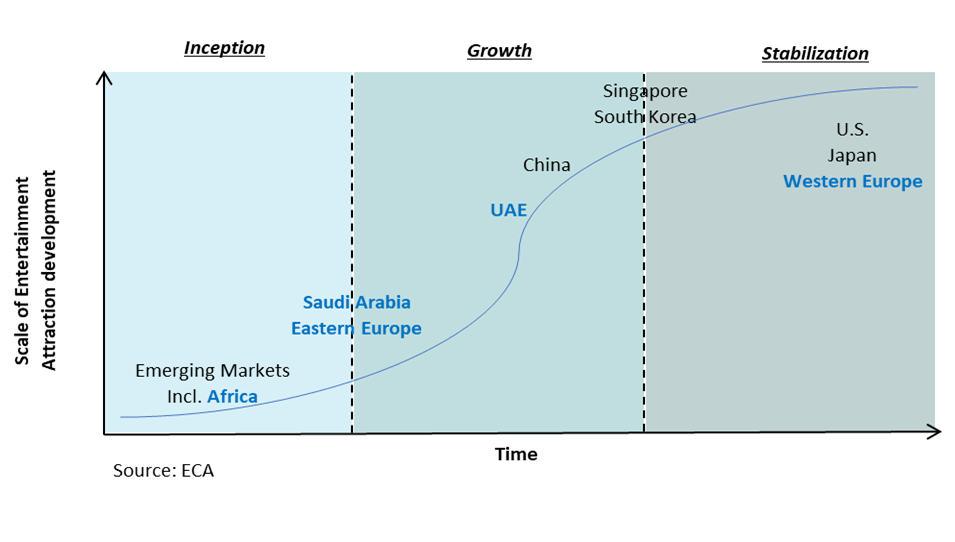

The EMEA region highlights the three fundamental phases of attraction development – inception, growth, and stabilization.

- Inception: Early-stage markets are characterized by Family Entertainment Centers (FECs) in retail malls, lower-investment outdoor amusement parks, and water parks. Most projects are unbranded.

- Growth: The quality and pricing levels of indoor attractions and water parks increase, and higher-investment theme parks are introduced. Branding and licensed intellectual property are used to heighten the profile, pricing power, and drawing power of the projects.

- Stabilization: As markets stabilize, the growth of new large-scale projects decreases and most investment is focused on reinvestment in existing projects. Smaller indoor attraction projects continue to evolve as older projects are replaced by newer concepts. Branding and IP are key points of competitive differentiation.

The EMEA region represents all three stages of development. Western Europe is a stabilized and mature market with most parks constructed several decades ago. Within the Middle East, the industry in the UAE continues to grow but is nearing a stabilization point as the focus shifts to reinvesting in existing large-scale parks and exploring new smaller-scale concepts – meanwhile, Saudi Arabia is transitioning quickly from inception into growth, as both public and private sectors are looking to introduce a broad range of international-standard attractions to the region including branded large-scale parks. Africa remains in the inception stage with limited commercial attraction development as leisure tourism continues to be driven by nature-based and cultural experiences.

Lessons for EMEA from global attraction industry trends and COVID-19 considerations

The onset of the COVID-19 pandemic was a dramatic disruption to the tourism and attractions industries worldwide. In 2020, closures and reduced capacities led to an attendance decline of upwards of 75% or more across leading destinations. Some improvement was observed in the following year as an increasing number of attractions reopened with a dedicated focus on operational efficiency and customer safety which have been crucial towards maintaining profitability under uncertain market conditions.

From an experiential standpoint, the economic uncertainty created by the pandemic has spurred developers and operators to lean further into more cost-efficient attraction formats such as temporary and traveling pop-up exhibits, immersive art experiences, and drive-through attractions. Within the attractions themselves, there has been an increased use of both outdoor and indoor space, where possible, to mitigate capacity constraints. In addition, the pandemic has continued to accelerate the implementation of in-attraction technologies with some attractions becoming increasingly touchless for transactions.

As we reach the halfway point of 2022, pent-up demand for travel and outside entertainment continues to be strong. Leading attractions are seeing higher revenues because of less discounting, more ticket-related upcharges, and higher in-attraction spend. In addition, governments have been acting to help support the industry. For example, VAT rates in selected European markets (notably in the United Kingdom) were temporarily reduced to further encourage consumer spending.

For many attractions, the resurgence in attendance has been driven primarily by local and regional residents with tourism still on the upswing. Local and domestic tourism is naturally recovering more quickly than international tourism given fewer travel restrictions along with the cost and convenience of traveling closer to home with staycations. But with tourism restrictions continuing to ease in many regions, international travel from a global perspective is reemerging.

Europe

Europe, particularly the western region, is one of the larger and more mature theme park and attraction markets in the world. At approximately USD 126 (EUR 120), headline pricing at Disneyland Paris trails only the Disney parks in the United States, which are priced at USD 159 for peak days, but is well above the counterparts in Tokyo, Hong Kong, and Shanghai. Outside of Disneyland Paris, the European theme park market is primarily characterized by smaller theme parks and amusement parks that are more regional serving.

Among theme parks, current development in Europe is primarily focused on in-park expansions and content upgrades, e.g., new lands, zones, and smaller second gates, such as indoor/outdoor water parks. Disneyland Paris is undergoing a EUR 2.0 billion multi-year expansion effort that will add, among other various attractions, lands for Star Wars, Marvel, and Frozen to Walt Disney Studios Park. Efteling in the Netherlands is adding a 143-room hotel within the gate as well as a new indoor attraction due to open in 2024. Phantasialand, based in Brühl, Germany, recently debuted Rookburgh, an immersive new land with a steampunk aviation theme, complete with a themed hotel and the world’s longest flying roller coaster. Futuroscope in Poitiers, France is investing EUR 300 million over 10 years to upgrade the theme park as well as add a new water park and hotels. Additionally, Puy du Fou in Toledo, Spain completed its EUR 183 million Phase 1 development, which includes the large-scale outdoor show “El Sueño de Toledo,” which debuted in 2019, as well as a 30-hectare park attraction, which opened in March 2021 and features multiple shows and a cultural village.

The industry in Europe is also seeing a renewed focus towards mall-based/urban entertainment attractions and branded experiences. In Berlin’s Potsdamer Platz, Mattel just opened Mission: Play! – a 4,000-square-meter family entertainment venue that provides physical and digital play experiences, edutainment, events, and experiential retail with themed areas for Barbie, Hot Wheels, and Mega Bloks. New LEGOLAND Discovery Centres are scheduled to debut in Brussels, Belgium this year and in Hamburg, Germany next year as part of mixed-use retail entertainment destinations.

Immersive walk-through experiences are also gaining traction. The Game of Thrones Studio Tour just debuted in Banbridge, Northern Ireland, featuring a self-guided tour on how the show was created, complete with official costumes, props, and set pieces. Harry Potter: A Forbidden Forest Experience is returning to Cheshire, England this year after a successful inaugural run in 2021, offering guests a nighttime forest trail with illuminated sets and themed food and experiences for fans of the Harry Potter movie franchise. And Frameless, which will be London’s first permanent immersive digital art experience, is slated to open in the West End later this year.

Middle East

The modern leisure and entertainment industry in the Middle East remains concentrated in the United Arab Emirates (UAE), specifically Dubai and Abu Dhabi. The region has successfully established itself as a global leisure destination through the rapid development of world-class attractions, entertainment, hospitality offerings, and supporting transportation infrastructure over the past 15+ years.

Already home to region-leading water parks, internationally branded theme parks, and events, the landscape in Dubai and Abu Dhabi continues to evolve. SeaWorld Abu Dhabi, a combined marine-life theme park and research, rescue, and rehabilitation center, is anticipated to open in 2023, adding to the Yas Island destination cluster.

For large-scale park attractions in the UAE, reinvestment in existing properties is a priority over new development as the market continues to absorb the current supply. Dubai Parks and Resorts recently expanded the Lionsgate zone of Motiongate – which now features two new rides in John Wick: Open Contract and Now You See Me: High Roller – and opened a 250-room LEGOLAND hotel in 2022. Aquaventure water park at Atlantis Dubai debuted a major expansion in March 2021, increasing the overall size of the park by a third and introducing 28 new waterslides and activities. The WB Abu Dhabi, a 257-room themed hotel integrated with Warner Bros. World Abu Dhabi on Yas Island, opened at the end of 2021.

Additionally, developers continue to explore opportunities for indoor location-based entertainment in shopping centers and tourist locations. Consistent with development trends in other major markets, there is an expanded interest towards “eatertainment,” which combines social games with a quality food and drink program in a trendy setting. Topgolf is a premium example, offering a fun and hospitable environment with a gamified driving range experience and chef-inspired menu. Topgolf Dubai, with a three-level facility spanning more than 5,600 square-meters, in addition to the driving range area, has a capacity to accommodate 1,100 guests, and has quickly become one of the global flagships for Topgolf since its public debut in 2021.

While the UAE is the established player in the Middle East attractions space, the Kingdom of Saudi Arabia (KSA) is the region’s emerging player that is fast entering the growth stage of the attraction industry development curve with several aspirational attraction leisure, tourism, and resort development projects in the pipeline.

The catalyst behind this transition is KSA’s Vision 2030, an ambitious framework focused on creating a well-diversified economy with a more vibrant, open society throughout the Kingdom. Entertainment is a priority sector in this strategic effort, and significant public funding has been committed to elevating KSA’s leisure industry from 2030 and beyond.

In prior years, KSA’s commercial attraction landscape has been primarily limited to mall-based family entertainment centers and basic amusement parks with off-the-shelf activities. Now, with the direct support of the Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia, there are several large-scale destination projects being planned for key regions in the Kingdom. One of the most anticipated is Qiddiya, an entertainment megaproject spanning 334 square-kilometers just outside of Riyadh, which will contain the region’s first Six Flags Theme Park, a world-class water park, and numerous other sports, arts, and attraction components. Six Flags Qiddiya is scheduled to open in 2023+ and will feature 28 different rides and attractions spread across 32 hectares.

Additionally, Saudi Entertainment Ventures (SEVEN), a fully owned subsidiary of PIF, is planning a destination water park in Dammam as well as an adventure park in the southwest city of Abha.

There are also several other megaprojects – dubbed “Giga Projects” – planned throughout KSA. They include: Amaala, a luxury wellness and resort tourism destination in the northwest of the country; the Aseer Development Project, a mountainous resort and tourist destination in KSA’s southern highlands; Diriyah Gate, which centers on a UNESCO World Heritage site, northwest of Riyadh; the resort and island based Red Sea Project on KSA’s west coast; and the most ambitious of all, NEOM, a $500 billion Smart City being developed in the northwest of the country. Each giga project is envisioned to include a selection of theme parks, water parks, and other entertainment and cultural attraction components.

Efforts are also being extended beyond large-scale parks and destination megaprojects. SEVEN is currently planning up to 20 urban entertainment complexes across the Kingdom. Each complex will range from 50,000 to 300,000 square-meters and feature a combination of unique shopping, dining, and recreational experiences. The goal is to bring these modern, integrated developments to not only the major cities, but also the smaller markets outside of Riyadh, Jeddah, and Eastern Province.

While the public sector is the main driving force behind the ambitious development, the private sector is also being engaged. Abdullah Al Othaim Investment Co., a regional market leader in construction, management, and mall operations, is looking to create new mixed-use destinations throughout the Kingdom comprised of restaurants, attractions, cinemas, and residential units.

Africa

Tourism in Africa remains driven by nature-based and cultural experiences. These include numerous national parks, nature/wildlife reserves, and natural landmarks and formations. Leading destinations include Victoria Falls in Zambia/Zimbabwe, Kruger National Park in South Africa, the Masai Mara National Reserve in Kenya, and Serengeti National Park and Ngorongoro Conservation Area in Tanzania.

In terms of branded, international attractions, one notable project that has been several years in the pipeline is KidZania Johannesburg, which is slated to be the second KidZania location in Africa after KidZania Cairo. However, in general, interest for major commercial attraction development in Africa is limited as the focus of developers and operators continues to be on other established markets in the EMEA region and reinvesting in existing assets.

Looking forward

While the world continues to adapt to the new normal, uncertainty still exists. It remains unclear whether there will be longstanding effects on tourist behavior once the pandemic phase ends. Additionally, new infectious variants may arise, or the rate and severity of infections may increase, which could lead to reactive changes to public and private policy that directly impact consumer travel and consumption.

That said, the industry in EMEA is trending in a positive direction. Attraction operators are still much better prepared than ever before with the proper tools and health and safety protocols in place should another outbreak occur. Significant development activity can be found among both public and private sectors, particularly in the Middle East, and many owners and operators are actively reinvesting in existing projects as they position themselves for the long-term.